Stocks, bonds, and crypto have folded like cheap suits in 2022. Yet residential real estate prices march higher even with mortgage rates doubling in the first six months of this year. As housing affordability indexes approach obscene levels, Frank and Ian look at what comes next in residential real estate.

—

Watch the episode here

Listen to the podcast here

Is Real Estate Next To Crash?

How are you doing?

I’m good.

We are talking about real estate and residential real estate, which is the center of Frankie’s life and also a big part of what drives our economy and everything else. Frankie was at IMN, which is a big real estate conference. In this episode, we are going to talk about some of the things that Frank took away and his gut feelings. We went through an agenda. We are not going to rehash all of the speakers. Frank’s gut reaction to these things is usually pretty accurate.

Interestingly enough, I was telling Frank that I talked to one of our customers about our car alarms. She’s from Sarasota. She’s 60 years old. She has two bartender jobs, one a regular gig at night and another one, she works on the weekends at a day club but is not too crazy. She has two jobs to pay the bills. She bought one of our devices. She was a hoot to talk to. Out of nowhere, she volunteers.

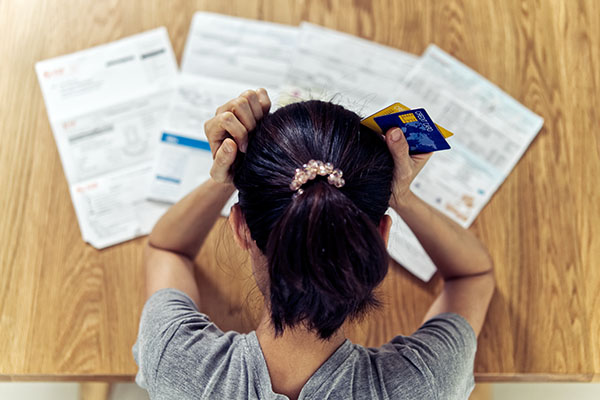

I was asking her about the affordability of our product and what she thought the price was. She wanted it because she bought a new Jeep. She’s like, “It’s a big investment for me. I don’t want anyone messing with my Jeep. I worry about it because I park in places where there are lots of drunk people. I don’t want any people breaking in. It would be expensive for me. It’s already expensive enough living. I don’t need people stealing my stuff.”

I said, “Tell me more. What’s going on in Sarasota?” She’s like, “I lived in the same house for twenty years. I’m not out shopping for a new house. I love my house. I feel so bad for all these kids that I work with as bartenders in these restaurants. They are paying $2,400 to $2,500 a month in rent. These are for crappy apartments in people’s basements. This is Sarasota. This isn’t even an exciting market.”

“I asked them, ‘How do you even afford that?’ I know what they make on bartender income. I don’t know how they are living. Their only answer is, ‘What’s the alternative? Where else can we live? We have already lived with our parents long enough. They kicked us out. You can’t buy anything because prices have doubled and interest rates are so much higher than they were that the payment on even the worst house I could buy would be closer to $4,000.'”

It was very interesting hearing someone’s perspective. The housing market needs bartenders and people that work in the service industry to buy a house. It can’t just be investment bankers buying houses and renting them. I found it fascinating that this is someone who’s not even in the market but is surrounded by people all day feeling a high amount of anxiety about rent prices and home prices. It was interesting enough that this happened knowing you and I were going to do an episode. I didn’t even bring it up. I was talking to her about a completely separate thing. She brought it up to me.

I don’t think what that lady talked about was the housing industry or the housing market. It’s inflation and life. There has been an enormous uptick in the cost of everything. I filled up my tank and I couldn’t believe it. It was $110.

It’s $130 in my truck. That was the highest I’ve ever seen.

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” – Warren Buffett Click To TweetI drive 1.2 miles to work. I don’t fill it up very often. It’s an expense for my business. It was still $100. I remember when $100 was a big deal. Now it’s a tank of gas.

It’s interesting that you brought that up. The same lady told me that she only fills up half her tank because when she fills up a full tank, it makes her sad. I heard that and thought, “That sucks.” I fill up half a tank. I know it’s BS but it helps me stay sane because when I fill up a full tank, it freaks me out. That’s wild when you hear some stuff like that.

I don’t want to get completely off the rails here but I don’t know why whenever there’s a Democrat in the White House, gas is $5 a gallon. We are protecting the polar ice caps but gas is $5 a gallon. There’s an affordability issue in America. It’s a big thing. If you think about where we have been in history, Occupy Wall Street was when Wall Street made a bunch of money and tanked the economy. People were out of houses. There’s an emotional component to this.

We are a free-market capitalist society. If we don’t have the masses able to afford things, it causes stress and strain. There are statistics about every time someone leaves the house and how many people die. The numbers are astounding. With every foreclosure, there are 0.6 deaths. That’s a real number. People have lost their housing. A shelter is a human need.

What we need to look at is this. I went to a conference in Miami Beach. When I went to this conference for the first time years ago, hotel rooms were $300 a night. Hotel rooms are $900 a night. You talk about inflation. It’s nuts. The first time I went to this conference a few years ago, there were 40 or 50 sponsors. This time, there were 300. You talk about things like getting a full head of steam and peak.

Everywhere you look, there are signs of warning. Maybe we are wrong. Maybe the home building industry will continue to go bananas and prices will continue to go up but what I hear is this. One of my favorite adages and we talk about him all the time is Warren Buffett, “When people are greedy, be fearful. When people are fearful, be greedy.” Everybody is greedy now. What are my takeaways? There were 300 panelists at this event, plus or minus. Less than 5% were contrarians.

What’s the general mood of everyone speaking? Who are these people getting up in front? I have been to IMN with you. I enjoyed it. I did think a lot of people were talking about their own books. Who were these people that are analysts? Who are on these panels that everyone is listening to?

If you would have gone to the first IMN many years ago, who was there? There was Wall Street, people from Blackstone, and very smart professional people from mostly sophisticated places like New York. That was who was there years ago. Now, it’s covered by service providers. There’s a company called Filtereze. If you own single-family rentals and you can’t solve how to change out your filters, hire this company. They will do it for you. I shit you not. The easiest thing to do in property management is to change a filter. There’s a company that will do it for you because people have gotten so lazy and bad at operations.

Real Estate Crash: It’s inflation in life. There has been enormous uptick in the cost of everything.

Many years ago, who was on the panel? It was smart people. Now, it’s sponsors. If you sponsor, you get the ability to be on a panel and speak. Your name is recognized. It says, “From so-and-so.” They are not going to ask you to promote your product on stage but you are going to be speaking and get publicity because you are a sponsor. Speaking your own book, most of the people were speaking their own book.

One of the biggest takeaways I had is, A) People are very bullish and, B) Almost everybody, the vast majority or somewhere 75%-plus of these people are half-cycle participants, which means they didn’t go through the last downturn. They came in at a peak and rode a peak or came at the bottom and have ridden it up. They didn’t ride it back down. Everybody or the vast majority of people are incredibly optimistic because they have never seen it before, and because they have never seen it, they are under this fallacy that it can’t happen because they haven’t seen it.

It’s funny you said the half-cycle things. When I came to the home building industry in 2007, I was trying to convince our president who had been around forever. He was buying real estate when the cavemen were selling deeds for their caves. He had seen a lot of downturns. I remember that I was arguing about something. It was some new lender I wanted to bring on. The lender was a little risky but they were replacing some paper that we didn’t quite have as a lender. He grinned at me and was like, “Your problem is you’ve got a baby face.”

I didn’t get it because I was young as hell at the time. I was half his age. I was 30 or 31 because this is three years into my being in the company. It was ’07. He’s like, “You’ve got a baby face.” I was pissed, “What does my age have to do with this?” He’s like, “You don’t have one scar on your face. You have never been through a downturn. You have no idea how ugly this will turn. You don’t understand because you’ve seen this market going up for a decade. It marches up. It slowly creeps. Every time there’s a good housing market, it keeps creeping like the water level.”

He was telling me this whole story. He’s like, “When it drops, it is violent. It is like a tidal wave. People don’t have time to react. If you were reacting before it drops, you cannot react mid. There’s not enough time.” It happened to us. I watched the whole ’80s while we steadily marched higher and grew. When the shoe dropped, in nine months, it wiped out 30% of people that were in this space.

He said, “I have scars all over my body from that experience. You have none. All you’ve seen is a great market. You want to keep pouring on the revenue. I don’t know when it’s going to happen but we are going to blink and be like, ‘It’s happening.’ If we are not prepared when it happens, we won’t be able to get prepared after.” When you said half-cycle, that’s all I can think of because I was a half-cycle kid in 2005, 2006, and 2007. You were a half-cycle kid. You have been with the company for a decade and you still haven’t seen a downturn. All you saw was good.

My thinking here is similar to what Ian said. A lot of people have only seen the upsides. If you read this regularly, what we talk about a lot are business, investing, and real estate. At our core, we are real estate guys. I don’t know how to read stock charts. I’m not as good as most people. It’s not where I spend my time. I spend my time on real estate. I want to say it from this perspective. There are two ways to acquire real estate. It’s with equity or debt. Equity is money. You can raise equity, which is expensive debt, or have your own money or equity and put it down.

Let’s make this simple. If you go buy a $100,000 house, that lender is going to require you to come up with somewhere between 5% and 20%. That’s $5,000 to $20,000 on a $100,000 purchase. That’s your equity. You have that against it too though because you have $75,000 worth of debt. People like me have tens of millions of dollars worth of debt. I’ve got more than $40 million to $50 million worth of debt. There’s a lot. The biggest variable or risk is debt.

If we’re not prepared when it happens, we won’t be able to get prepared after. Click To TweetPeople don’t lose their houses because of the equity. They lose their house because of the debt because the debt requires servicing. In English, that means you need to pay for it. When people get foreclosed on, they lose a job. They can’t afford it. There’s a risk. What I look at is this. I’ve worked hard. I’m not brilliant but I’ve tried to become as smart as humanly possible in what I do. I try and figure out how to read the tea leaves. I talk about reading the Wall Street Journal or paying attention and listening to people.

I have been doing that stuff for years, so I don’t have to be homeless or have to deal with the pain. This is my opinion. I look at what causes risks to me. The biggest risk to me is debt. I’ve got a bunch of it. Am I wrong that we are at a peak? I don’t know. We will know soon. I don’t necessarily think we are going to see huge drops now in pricing but what I do think will happen relatively fast is it’s going to be harder to find liquidity, which we are going to come back to. I do think now is a great time to sell.

If you own something that isn’t sheltered and it’s just an investment, it’s not a bad time to sell. If you own everything in cash, maybe not but if you do have debt, now is a great time to have a little bit of extra cushion. You look at me and say, “Where are you at the moment? What are you bullish on?” I’m bullish on liquidity. There’s a lot of liquidity in the market, which we are going to come back to.

I’m bullish on selling. I’m a net seller more than a net buyer. It’s a smart time. I’m looking at the charts and what I see. Maybe I’m wrong but there are houses that I bought for $30,000, $40,000, $50,000, and $80,000. I showed Ian a picture of a house that’s on the market. It’s 800 square feet. It was $240,000. I bought that same house for between $20,000 and $50,000. It’s a dump. It’s got a tarp on the roof.

Frank bought it and sold it. He didn’t do shit to make it better. He just threw a can of paint and flipped that bitch for another $20,000.

That’s a funny joke because I bought 75 houses. There was a write-up in the paper. Someone is like, “Hopefully he’s going to renovate these things.” I’m like, “Cava just throws a can of paint on them.”

That’s true for about 30 of those 75.

Whatever Ian thinks, I’m getting a little bit of a big head. He reminds me of what the market thinks. The point of it is this. I have a friend of mine who’s 70 and his wife is 60. He asked me, “What do you think?” I went into my strategy. He goes, “I’m talking about monkeypox and Ukraine. Think about bigger things.” He may be a little bit reflective. His wife and I were talking about stuff. We do a lot of business together. She was like, “Years ago, I had more debt. I have less debt.”

Real Estate Crash: We’re a free market capitalist society. If we don’t have the masses being able to afford things, it causes stress and strain.

I thought about that for a few days. I’m like, “She’s right. She’s got a less stressful life than me because she doesn’t have many debts.” Ian and I both lived through the pandemic. He had a different experience than me. He played baseball with IJ. He didn’t have debt. I had a lot of debt. The way that I look at it now is this. With the number of assets that I have, now is a good time to sell someone a very high number where I’m going to make a great profit. I’m going to walk away from it having a lot less debt when that’s over with and get to a point where I have a little bit less stress.

Is that the right thing for you? I don’t know. You have to pick. The reason I’m doing it is this. I want less debt or risk. I want more cash. Liquidity is strong. If liquidity is strong, banks will lend to you. Now is a great time to get a home equity line of credit against your house. The value is high. You probably have equity. You don’t know if you are ever going to need it but the time to have it is now. When you have as many assets as I have, now is a great time to have big lines of credit. Years ago, I changed accounting firms and moved over to one. They are not the big four but they are in that next tier.

People like Wells Fargo listened to their accounting and said, “This guy is a good risk because he’s got good books from this accounting firm.” I’m getting lines with them. Why? Sometime in the future, there’s going to be an opportunity to buy. The market is high and hot. Now is a great time to sell, have less debt, and have cash. You will have multiple options with your cash. What I heard at that panel is, “Go.” There is no way in hell this market comes down, which is the reason and the moment when it starts to.

Frank did a great job of explaining equity and debt. Let’s take the property that Frank bought for $25,000 years ago. It is now listing for $250,000. Maybe it goes for $250,000 or $230,000. Who cares? It’s roughly 10X what Frank could have bought it back then. It’s only older and crappier now than it was when Frank owned it. It’s only going to be more expensive to operate that thing.

Also to fix it because the cost of materials has gone up.

Are the odds better of it going up another 10X or dropping 50%? Even if it drops 50%, that’s a 5X increase over what you bought it for many years ago, which is still incredible, historically speaking in real estate to go up to 5X over a decade. If that thing drops $50,000 to $100,000 and someone put 80% debt on it and they can’t get rents on it, that’s when foreclosure starts. To me, when you go look at a market that has done what it’s done, you go look at the Case-Shiller index. It’s up 60% to 70% in the last decade.

You can find very few periods in the history of the Case-Shiller index where you are up 60% to 70% over a decade. One of them is the Great Recession. Does that mean this is 2008 and we are collapsing? I don’t think so but in 2005, we knew this is completely unsustainable and that it was going to end terribly. We just didn’t know how it was going to end terribly but we knew in ’05 there was an irrational market that was doomed to fail. It’s feeling a lot like 2005 to me because I see so many people that are completely priced out of the market. There’s no sanity with these debt-to-income ratios.

In 2005, I was 30. I had become a Sales Manager. I was working in a suburb of Washington, DC. I was about 45 miles West of Washington, DC. I got promoted to the job. There was a woman who was getting ready to go on maternity leave. For three months, she trained me. Her last day was right around Memorial Day. She went on maternity leave and came back on Labor Day. She left on May 31st and then came back in September. What changed was this.

People don’t lose their houses because of equity. They lose their houses because of debt. Click To TweetWhen she left, we were constantly raising prices. Prices were going up $20,000, $30,000, and $40,000 on weekends. We would sell eight houses in a month. We raised the price a bunch n the neighborhood. This is how builders control inventory. I sat in my office. I was fighting to keep three contracts from canceling because if you have a sold contract to somebody who paid a price from 6 to 12 months ago, they are going to pay more than what the market is going to pay for it now.

What you are better off doing is what’s called retrading or renegotiating the contract. She looked at me and she was like, “What are you doing? We should be raising prices.” I’m like, “You have a three-month-old. The whole world has changed.” If you have ever had a baby, your world has changed already. Her world changed twice. She had a kid and what she was standing on was no longer solid ground. It was quicksand. We had to renegotiate the price.

This was June, July, and August of 2005. When you talk to most sane people who are paying attention, they will tell you that the housing market started to dip. I’m like, “They are wrong.” The housing market started to dip in 2005. The greater population started to feel it in 2008. Between 2008 and 2012, it continued to come down to a point, where about 2012, Wall Street said, “These houses are now underpriced compared to the replacement value.”

There is a trade here. They are buying a discounted asset at a low number. They are going to get in at a low basis where it could go down but it can’t go down a ton more because it doesn’t make any sense that it could. Eventually, it will come back up. That’s what happened in that stretch of time. What I’m telling you is it is not 2008 in housing. Everybody is still very optimistic.

In 2008, the housing market wasn’t optimistic. In 2005, it still was but there were smart people who noticed. The story is changing. The fundamentals are different. We are no longer raising prices. We are there. You could still get your NINJA loan in 2005. You can still get a home equity line of credit now. In 2008, you couldn’t. In 2026, I don’t know if you could. The point is the tide hasn’t gone out yet. It’s going to. In the stock market, the tide is out a little bit.

The tide is out a little bit on Bitcoin. I know nothing about Bitcoin. I knew Bitcoin was going to crash when I was at a playground and heard some people talking about Bitcoin like plumbers used to talk about internet stocks in 1999 and 2000. You knew it was going to crash when that was going to happen. The point of the matter is if you are in real estate and invested in it, it’s still early. There’s still time. Ian and I have talked about this a bunch because this is where we are.

It’s still time to consider lightening your load. We are within the last couple of years of this cycle. If you are buying, you are hoping that there’s a greater fool coming behind you that’s going to buy it at even a little higher price after that. Unless you can get deals and you are particularly good at adding value, the speculation of buying and expecting it to be higher is a little bit of fool’s gold.

To give numbers to this, in the first quarter of 2007, the median sales price of all homes sold in the United States was $257,000. That was Q1 of ’07. That was the last big peak. It went through a period of 5 to 6 years where it took 5 to 6 years to get back to that peak. Since then, it has been off to the races. We hit another peak in the fourth quarter of ’17 with $337,000. Now, it stands at $424,000.

Real Estate Crash: Now is a great time to sell. If you have debt, now is a great time to have a little bit of extra cushion.

That’s a 69% increase over the previous peak when people were completely priced out of the market to the point where people had to take out complete bullcrap loans that didn’t make any sense with teaser rates and subprime to get anyone into the market they could. That’s the last one. We are now officially 69% higher on the median than at the peak of the insanity of mortgage lending that drove those prices way higher than they should have been.

For me, maybe there’s still time but there’s time to sell. I wouldn’t be looking at residential real estate unless you have an operation like Frank that is good at spotting a great deal and adding value. Frank calls this wholesale. If you are buying and looking to sell it right away, you are hoping that some fool is going to pay more than you did. That’s all you are hoping for.

It’s the bigger fool theory.

It’s at an absolute peak of pricing. I don’t know if it won’t go up any higher than here but what I can tell you is we are at a peak all time and by a lot. We have blown through any rational trend line. Go to the St. Louis median sales price, google in St. Louis Fed, and look at this chart. It looks like the tech boom of 1999. It looks that insane. We only add 3% a year to our population. Where are all these buyers coming from? This is asset inflation because we haven’t started enough houses over the last few years. There are more people fighting for less supply. It ends badly because people can’t afford it. They are not going to keep doing it.

There’s going to become pressure at some point in the not-too-distant future on rates. If we continue to have inflation, which we probably will, the government is going to have to continue to raise interest rates, which is going to cause a major affordability problem. The government has to pretty much stimulate the mortgage industry in some way. They are going to have to create a product. It will mostly come out through FHA, which is government-owned.

What they will do is come up with products. There’s a 30-year fixed mortgage and an ARM, which is an Adjustable Rate Mortgage. If you have a 5/1 ARM, it means that it’s fixed for five years. The one means that can adjust every year after that. There are caps. If you have a 5% interest rate, you are going to be capped at no more than 2% for any year and 6% for the life of the loan. That’s usually how an ARM works.

A 30-year fixed means it’s fixed for the whole life. If the 30-year fixed rate is too high, people use either an ARM because the rates are a little bit lower or they have to use what’s called the buydown. When I got into home sales, there was a 2-1 buydown. Our boy, Kenny, who we talk about all the time, talks about how in the ’70s and ’80s, there was a 5-4-3-2-1 buydown. It would go back five years to get the rate lower.

There’s going to have to be some product because the people in the market can’t figure out how to pay. It’s too expensive because of the rates. There’s going to have to be an incentive but if we have to do all of these things, prices will adjust. These are the warning signs that start to come up because we have scars. I’ve got wrinkles on my face because I’ve gone through this and I worry about it all the time.

There are just more people fighting for less supply. It ends badly because people can’t afford it. Click To TweetWhat happens is people get pissed like they are pissed off about oil and gas prices. They threaten to vote for different politicians. New politicians come up and arise who say, “I’m going to run on low gas prices because I can see that people are pretty pissed off.” The president starts changing his tone. Maybe he’s going to go meet with ExxonMobil to try to get some good favorability with the people saying, “I’m now partnering with major providers to see what we can do.”

New politicians will come in and say, “We have talked to all of you in your town halls. Housing affordability is important. We are going to run and revamp Fannie and Freddie. Here we go again with FHA. We are going to come out with a 40-year mortgage product and maybe bring some interest-only payments to get your payment down.”

This all sounds familiar because the truth is it’s never different. Prices get too high. It’s not affordable. Politicians get involved, try to manipulate the market, and do things that they know haven’t worked in the past but they are making decisions based on the short-term angst of the populace. That’s going to happen. Do I see home prices collapsing in the next 6, 12, and 18 months or even 2 years? I don’t.

I’m shaking my head vigorously no.

There will be another surge because what is going to happen is the same reason why we couldn’t leave it alone. It’s all politics of everything we have done and the trillions of dollars we spent on stimulus for COVID. That’s politics. That’s trying to buy votes. There will be more votes bought through housing subsidies because people can’t afford it until they blow up. When home prices collapse, it’s almost always a banking issue. It’s almost never a true supply and demand issue.

It’s almost always some lending crisis that happens where there’s a crisis of confidence. People foreclose and banks collect their money. When they sell an REO or a Real Estate Owned property of a bank, then they are going to sell it at whatever the hell they need to sell it at to cover the loan. I don’t mind dropping the price to 30%. That destabilizes the whole market. That’s what’s next. What’s next is probably more stimulus and stupidity by the government to keep this thing going into a few more innings.

What’s the front-end ratio?

A debt-to-income ratio is principal, interest, and taxes. It’s your mortgage payment versus your taxable income.

Real Estate Crash: There’s no sanity with these debt-to-income ratios.

A front-end ratio is something that every lender and most people in this industry should know. Most people I’ve surveyed do not know it.

Here’s a quick example. I make $10,000 a month.

You make $120,000 a year and $10,000 a month.

Your mortgage payment is $4,000. My front-end debt-to-income ratio would be 40%.

What that doesn’t factor in is food, gas, household expenses, credit cards, daycare, alimony, and anything else you must pay. The industry average or the median front-end ratio in the US is 38%, which means that people are paying 38% of their gross, not their net towards their housing, which means we are at the peak of affordability. We are about to clip over affordability. Ian understands underwriting ratios better than I do.

That’s an insanely high number.

It’s something around 32%.

That’s a number that one of the panelists says. That must be a new issuance because you have people that have been living in houses for twenty years.

There are never foreclosures in a market that’s screaming higher. Click To TweetThis isn’t the average.

It must be 2022 new mortgage applications. Thirty-eight percent is a high number. Normally, a safe number is 28% to 31%. If you get higher than that, then an underwriter is taking a cross-eyed look at it.

Thirty-two percent is the number where I thought it was starting to get high. At 35%, you’ve got to white-knuckle it. Thirty-eight percent was high.

Frank is talking about the front ratio. They call it a front and a back ratio. The back ratio is total debt. That’s also taking into account any credit card monthly payments you have and if you have a car payment. Any other regular payments that go out farther than a year are added in. Someone with a 38% front ratio likely has a car payment, some credit cards, and student debt almost always that you run into. They are probably pushing 50% to 55% of their take-home. The pre-tax income is going to the debt they already have to pay. They get taxed. They’ve got themselves a couple of hundred bucks to buy groceries and gas. That’s it.

Here’s, what’s crazy. The median sales price of a home now is $428,000 but interest rates have gone up. You could have bought a $400,000 house but that same house or payment is now going to buy you a $240,000 house. That’s a staggering number. A $240,000 house is now selling for $400,000. People don’t say, “I’m in the market for a $400,000 house,” and then go and decided, “I will buy a $260,000 house.” It’s a significantly different house. That’s not the same ballpark.

What will happen is people will continue to stretch to get in or wait. 1 of 2 things starts to happen. People stretch while their car breaks down. They have to go to work. They fix their car but fall behind paying for their mortgage. There’s no longer forbearance. These people because they are on a razor-thin line go to foreclosure. There haven’t been any foreclosures in the market in several years because of all the forbearance. We are sitting on something in the neighborhood of nine million pieces of inventory.

There are nine million pieces of inventory that are hanging out there that are ready to be foreclosed on, which is going to add to the inventory. We are at a razor edge up top. People are going to have a hard time paying. They are going to fall behind. There are already people who are behind that haven’t been able to work through the system. When we start talking about the fact that there’s no inventory, if this stuff starts hitting the market quickly, it’s going to change the inventory scenario very fast.

There are no foreclosures because the home prices are going up 15% to 20% a year. Let’s say you lose your job, even without the government’s stimulus and help. If you fall behind on payments and you can’t make the payments anymore, you list the property for 25% more than you paid for it. That covers the debt. You are done. You don’t have to foreclose but when prices stop, this is the musical chairs atmosphere that we are running into when prices stay flat.

Real Estate Crash: It’s almost always a banking issue. It’s almost never a true supply and demand issue. It’s almost always some kind of lending crisis that happens when there’s a crisis of confidence.

We did an episode on why we think a recession is starting. We think there are going to be a lot of people that lose their jobs and the unemployment rate is going to creep up. We have a lot of reasons that we give for that. If that happens and home prices stay flat and don’t go up, those people can’t sell their house and cover the mortgage. They are going to foreclose. That brings a whole other wave of pain into the economy when that happens. There are never foreclosures in a market that’s screaming higher. The reason is you can sell the house, cover your debt, and pay the bank back by selling. You get bailed out by the market speculation.

We have been at an all-time high in pricing since somewhere around 2017. If we come underneath that, then this ends. You are correct that most people do have equity but I’m in business because people don’t know how to realize equity. They call me or someone like me because even though they have X number of dollars in equity, they don’t know how to put it on the market. They are scared of the process. We are seeing almost 100 people per week that are in some level of foreclosure who are calling us or reaching out to us because they want us to come. I serve in a very small market. These things are becoming pretty real.

The vast majority of the price points you play at are FHA or VA buyers. They have a very high percentage of equity. You can get 97% or with a gift almost 100% loan on some of those. In those spots of the market, if markets stay flat at all, they are done, whereas, in conventional loans, you tend to put down 15% to 20%. You have a little more cushion. Frank is playing in a world in that $150,000 to $350,000 range. A high percentage of those customers are government loans with high LTVs or Loan-To-Values.

A government loan means it’s non-conventional. In a non-conventional, someone who isn’t the government is going to back that. It has to perform but the government rounds in the favor of the everyman and the person who needs help getting into a house. They lower their borrowing standards because the US government wants people to be on their own and own a home versus living in something subsidized.

It’s still a little bit of a subsidy but it’s slightly different and creates home ownership. That’s the grouping of people who hit first. When I bought my house, I put down 35% on an expensive house. If you are buying a starter home and you only could put 3% down, you don’t have money for blinds or furniture. Things start to happen pretty quickly.

I’m going to pivot to something a little bit different but it’s comparable. How did we get here? Let’s talk about it. Everybody talks about the black swan event. The black swan event is COVID. COVID comes in, the market, shuts down, and everything stops. We are all living from home and using Zoom a lot more. Everyone is watching the show with the guy with the mullet and the tiger. That poor guy or the porn star showed up in every picture. Everybody was bored.

We have this period of 3 or 4 months. Everybody gets crazy and the government prints a bunch of money. There’s a black swan event with COVID but there was another black swan event. It’s housing. In 2020, nobody wanted to sell because nobody wanted a stranger in their house. Unless you had to have somebody in your house, every person you looked at who wasn’t your family you thought could potentially kill you.

If you didn’t have to sell, you didn’t sell. There’s no inventory. In 2021, the vaccine comes out. People were starting to open up and the world was starting to change a little bit. The fundamentals of the market have changed since 2020. The best and smartest thing I heard at this event was this. 2021 was the black swan event for housing. Here’s why.

2021 was actually the black swan event for housing. Click To TweetThere was no inventory in 2020. The cause is supply and demand. It’s simple. If there’s no demand, the price goes higher. If there’s no supply, the price goes higher. In 2021, prices went up, and then human emotion took over. People who were probably not in the housing market until 2022 or 2023 were like, “All these houses are going for sale at these astronomical numbers. If I don’t get in now, I can’t get in.”

The animal spirits.

It’s FOMO or Fear of Missing Out. In Q1 of 2021, the median housing price was $370,000. In Q1 of 2022, it’s $428,000. That’s $50,000. That’s 15% in one year. It’s because of all of the factors. It’s not sustainable because of the fact that we had this weird thing that happened. The black swan event is the housing. There’s no inventory. Nobody is shopping and doing it. You factor that, “I will never be able to buy a house. I will get in now.”

My wife is a professor. Her friends are brilliant but none of them know real estate. During 2021 and the beginning of 2022, I can’t tell you the number of her friends that were like, “It’s time for me to buy a house.” They are feeling that they are going to miss out. There’s this weird mad rush of people getting into the market. What happens with that when everybody is running in is the smart people are selling and getting out.

You compete with everybody on deals. You are trying to buy and sell deals. Are you seeing a different avatar of a person who is offering money to you for your properties when you sell? Are you competing with different people when you buy? There was a period when New York was all over the place. They would come to swoop in and buy big batches. Do you still see some of that? Is it a little different?

I’ve got friends in San Diego. I was talking to a realtor friend of mine in Richmond. When the market went bananas, you would start to have bidding wars, sight unseen. People were buying. All the fundamentals upon buying went out the window. You start to see this crazy stuff. You get 10, 15, 20 or 30 offers. If you would have an open house on Friday and Saturday from 8:00 AM to 8:00 PM, you wouldn’t even be able to get an appointment. It was that nuts. That’s over. In the old days, when you used to get 10 to 20 offers, you now might get one. Instead of you getting even an offer on the first weekend, you might get an offer on the eighth day it was listed.

They are tired of losing, the euphoria, and all that. They pull back a little bit. Affordability has changed drastically. I talked about FOMO or the Fear of Missing Out. If you needed to buy a new home for need, not for want, you did it. You’ve already done it. You’ve got someone who is a little bit more discretionary or somebody who is not in a must situation. If someone is not in the must situation, what happens is they don’t buy and they are not flocking. That’s part of the equation. I will get to the professional buyer.

On the selling side as you are selling multiple, are you seeing different folks that are interested in buying from you? Are you seeing the prices changing?

Real Estate Crash: Affordability has changed drastically.

This is the crux of what we are talking about. I still think there are people who are optimistic. You get into this flywheel situation. Single-family residential real estate has become a self-fulfilling prophecy. There are people who make 100% of their living flipping houses, buying them, and selling them. They haven’t adjusted their buying parameters.

The professional buyers have. When I say professional, I don’t mean you’ve quit your job and you do four a year. Wall Street has looked at their perspectives a little bit. I do think by and large that there’s still a lot of euphoria in the market from a selling perspective. People haven’t come to the reality of the fact that on the backend when it’s time to sell, the markets can be weaker.

Here’s an interesting statistic. From the same conference, I learned that several lenders have said they have gone through the most extensions by a percentage that they have ever had to give to flippers. You get a 9-month note or a 12-month note. What you need to do is extend. You are extending for a few reasons. You can’t finish the product if you are selling it. There are supply chain problems, permitting problems, labor shortages, and all those things.

In addition to that, you are also dealing with how interest rates have ticked up. If you have a fix and flip that you’ve turned into a rental and gotten ready, you can’t refinance it now because the interest rates have gone up. It no longer cashflows. You say, “Screw it. I’m going to pay my private moneylender an extra quarter but that costs money.” If the market doesn’t continue to appreciate over time, what happens is those things eventually get foreclosed on.

I had meetings with two private lenders in my market and said, “Are you starting to foreclose?” They are like, “Yeah.” I’m like, “I’m a buyer, FYI.” You and I have talked about that privately. Both of them are like, “I didn’t realize you do that.” I’m like, “I will self-perform the work for you. You can carry the note.” They are like, “I haven’t had to foreclose on anything in years but I’m foreclosing now on 30 properties out of 400 that I own. That’s why.”

In the last downturn, we were still servicing a bunch of mortgages that we weren’t able to sell for a while.

Explain that because most people don’t know what that means.

We send you payments. It was our job to make sure that you paid every month.

As we move into a recession, we're at peak prices and people are up to their throat in debt with record debt to income ratios. That's all coming. Click To TweetIan worked for a big lender and a big lender worked for a home builder. Normally, what they do is get the loans, securitize, and then sell the paper or the note in a package tranche. You heard last time in the downturn. If you ever saw The Big Short, it talks about mortgage tranches. They would sell that tranche of paper. The NVR would sell it to somebody else, somebody else would send you a payment booklet, and you would make that payment. What Ian saying is they couldn’t sell it or make their margins. They would hold the paper or service it themselves, which means they still have the debt. They haven’t been able to sell it.

We started having foreclosures people couldn’t pay. We are talking to them but we didn’t have the skill set left in our organization to deal with the foreclosure. When you get into it, it’s like, “It’s foreclosed.” You have to give them notice to move out. If they don’t move out and give you the finger, you have to get a sheriff. Depending on the state you are in, there are different laws. They might give them 3 or 6 months in some places.

In the meantime, they are destroying your house because they are mad at you. They start tearing the walls up and breaking toilets with sledgehammers and all kinds of disgusting things because they are mad at you as a lender. There are no laws to go pursue them because they are foreclosing. They are already bankrupt. It’s like the old Charles Rogers with the Lions. We drafted him first. He ended up becoming a loser. The Lions sued him for a $30 million signing bonus. He said, “Come get it. I smoked it all.” He was bankrupt. He had nothing.

To tell you how bad this gets, I will give you a real story. I own a house. Of all the houses I own, about one time a year, someone goes through the entire house with a hammer. When I go into the house, we check these things quarterly. Within a quarter, they have taken a hammer and there’s no longer drywall. I’m not kidding you. They take a hammer to every piece of drywall in the house. It’s down to the studs.

They are selling the copper and whatever they can get their hands on.

It’s incredible. They are fleecing you.

We started reaching out to some people and saying, “What are you doing for foreclosures?” Even the big banks and servicers didn’t have the skillset anymore. They didn’t know what to do. It had been a decade since there were lots of foreclosures. They had to build entire departments to deal with foreclosures, delinquent payments, and all of that. That’s all coming again as we move into a recession. We are at peak prices. People are up to their throats in debt with record debt-to-income ratios. The point we are both making here is it could take 2 to 3 years but it started already.

Real estate is historically hard to see coming because it’s such an illiquid investment. There’s debt. You have to go through underwriting. There are multiple payments versus when people panic in crypto, they get in their Coinbase app and hit sell. They are out. They take their 50% loss. You can’t sell a house on an app. You have to list it. People have to look at it. You have to make it look nice. It’s a clumsy thing to sell or even buy, whereas we have seen the pain in the stock market and crypto already because they are incredibly easy to buy and sell when the market readjusts its prices. There’s not a lot of debt in either of those two.

Real Estate Crash: You’re worrying on speculation. It’s not a great time to speculate.

It’s a very liquid market where if a house is illiquid, it takes a lot more time to get there. There’s a big difference between doing an episode at home and in my office. At my office, nobody bothers me. I can send a text and someone will bring me a cup of coffee or water. While I’m home, my wife will send me a text that says the real gas prices by presidential term refuting what I said earlier.

She overheard you. She had something to say about you making fun of Democrats and gas prices. There’s no doubt it came from CNN or some other BS watching. You know it’s legit when it comes from Yahoo. Take us home, big guy. What should people do if they own some investment properties? What should they do about real estate? What are some takeaways?

The biggest takeaway for me from this conference is everything was speculative. Everything was benders. In the last panel, nobody was left. On the first morning, there was standing room only. They said, “We can’t let you in because we are at overcapacity.” In the last panel, there was probably a capacity of 1,000 people and there might have been 80 of us in the room. It was for two economists.

One of them is Domonic Purviance. He’s with the Federal Reserve Bank of Atlanta. He said the following and I love this, “I had a professor. If you look him up, he’s got a pretty strong resume of where he went to college and got an MBA.” I had a professor who said the following, “Demand equals people plus bucks.” He kept coming back to demand as people plus bucks.

The genesis aside, we are going to have people but bucks is the big thing. What I see in the market is there is still a good amount of liquidity. What that means in English is the government printed a bunch of money. People have more savings than they have ever had. They have equity in their homes. People are frothy. People are looking at deals with Ian and me to invest in Keep, the car alarm company. They want to invest in our real estate deals but Ian is already talking about it in an episode we did prior.

Venture capitalist firms are having a harder time raising money because the bucks are starting to move away. In the housing market, bucks are becoming less valuable. There’s inflation. Interest rates are higher. What’s happening is the people are going to remain but the bucks are going to go away. As the buck starts to go away, this market gets hit.

When Alastair was on, we talked about the whip handle. The whip handle is the First World countries. The end of the whip, which you hit the animal with is what ends up happening. Real estate is not on the whip handle. The stock market and equities are the whip handle. The actual whip is the housing market. What we are telling you is we believe that the whip is coming.

If you want to get yourself to the handle, which is a much more comfortable spot to be, be a little bit more in cash, have a little bit less risk and debt, and have those things set up. I make a joke constantly. When the tide comes in, which it will, do you want to hit your ankles or knees? Do you want to need a snorkel? I do not want to need a snorkel. I prefer if it didn’t even come up to my knees. Maybe it touches my ankles.

The whip is coming. So, if you want to get yourself to the handle, have a little bit more in cash, have a little less risk, have a little less debt, and have those things set up. Click To TweetMy risk profile is different than it was years ago. We are at a different point in the market. To me, the thing to do is be cautious. If you see a great deal, underwrite it with good standards, “I might not get any appreciation and have depreciation for a while.” Warren Buffett talks about not timing the bottom of the market. He doesn’t need to time the bottom of a market. He didn’t buy it at its absolute peak. It could come back a little bit but he knows he wants to own it for years.

That’s the beauty of the real estate. You need to own it for years. If you are cool with that, it’s a great time to buy but if you are not cool with that and you are worrying about speculation, it’s not a great time to speculate. Be honest. It’s a 12 to 14-year bull run in real estate. Look at some charts. That’s a long time. Now is a great time to be a little bit heavier in cash, not speculate as much, and think, “A storm is coming. How do I want to prepare for it?”

The only thing I will add to that before we wrap this thing up completely is if you are going to invest in anything, invest in things that have good cashflow and invest for the specific reason of cashflow. It’s the time to invest and hope there’s a greater fool after you to pay more money. All the value you add is you think you bought something at a special price. That is a foolish way to go about investing. Go for things. If you buy something, you say, “That’s in a good market. It’s going to cashflow. I’m going to get paid on a monthly basis.”

It’s the same with stocks. You buy stocks that are generating good cashflow and have large hoards of cash. When times get rough, they will be able to invest. It’s the same with real estate. Don’t buy it hoping that the price will go up. The odds of it going up and you timing it perfectly before it goes back down, historically speaking, we have not had many runs like this in the last 130 years in America price-wise if at all. They have all ended badly.

Does that mean it’s ending badly now? No, but they all end badly, especially for the people that bought properties at the end and put a lot of debt on them. That’s how it ends badly for you. If you are going to go buy something, you are thinking about putting 90% to 95% debt on it at these prices, and you don’t have a big store of cash that could get you through a 2 or 3-year downturn, you deserve what’s coming to you because it’s going to end badly for you.

If you said, “Summarize this in 30 seconds or less,” what I would tell you is this. Be honest about your cash position and your expenses versus your ability to get the cash. When I quit my job in 2009, a bunch of people called me. Ian is the only one who called me and said, “Are you okay financially?” I said, “I could probably live for ten years without a job. He goes, “That’s pretty good.”

I can still do that. It’s not all in cash. I’ve got some equity and things that I can do but that’s maybe a little bit too much cash. The point of the matter is this. Do you have access to it? If your legs get cut out from underneath you, can you survive? It’s up to you to think about those things and imagine a worst-case scenario. If you imagine a worst-case scenario and you can make it through it, that’s perfect.

I use the analogy all the time of going into a recession. Who is on your lifeboat financially? How do you get on the lifeboat and live? Who are the people around you from a personal perspective and work perspective? Who gets on the lifeboat? Who makes it? If you are honest about that, we still have time. We are not yet officially in a recession. We are certainly not in a housing recession, contrary to what all those morons are telling you. I do believe it’s coming and it’s up to you to be proactive, take that, and move forward with it.

Real Estate Crash: If you’re going to invest in anything, invest in things that have good cash flow and invest for the specific reason of cashflow.

Get your house in order. We always talk about how no one thinks about the downside and what could happen. We have now tipped to the point where the risk is much higher than the reward. If something bad were to happen, how would you weather the storm? There’s a storm coming. I don’t know if it’s a category five hurricane. I probably don’t think it is or if it’s going to be a Nor’easter variety or whatever they call them.

I don’t know but it makes sense to go put some storm guards on your windows, stock up on some extra water, and have your house in order that you can make it through a couple of years of an ugly environment if possible. Now is not the time to go get levered up to your eyeballs. Now is the time to try to get a little more cash. Maybe you don’t have ten years of spend like Frank but stretch it.

You shouldn’t have two months of spend because when it happens, I will go back to my president who told me I didn’t have enough scars. He was right. As soon as public confidence panics like animal spirits will take a market up, they will take it down so fast. People will pull their money out faster than you can imagine. When it happens, you don’t have time to do the things we are talking about doing.

We will end with this. When you think of biblical references, I know I come to mind near the top. Ian, when did Noah build the ark? Before the rain.

That’s a good point. Noah is in the Holy Bible. Is this the St. James version?

Have you ever heard of Noah’s Ark?

I have. Wasn’t that Russell Crowe? Didn’t he play him in a movie on the same topic?

It’s Steve Carell. The point of the matter is if you use the reference and it goes back thousands of years, Noah built the ark before the rain. What we are saying is it’s going to rain. Whatever your ark looks like, build it now.

If you are not filled with the Holy Spirit like Frank Cava, you should have more cash.

Important Links

- IMN

- Federal Reserve Bank of Atlanta

- Keep

- Alastair MacDonald – Previous episode